Kenya to get business centre worth R1.7 billion by March 2020

Improvon. a South African industrial property developer has teamed up with Actis, a private-equity investor to build the biggest industrial real-estate investment in Kenya’s history.

August 23, 2019: Improvon. a South African industrial property developer has teamed up with Actis, a private-equity investor to build the biggest industrial real-estate investment in Kenya's history.

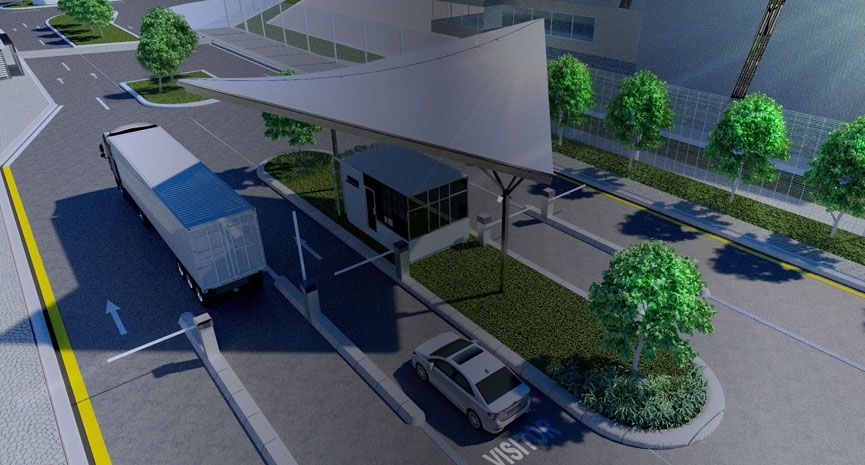

The two companies have created a joint venture called ImpAct to build the 10,000 square metre industrial business park development at an estimated cost of R1.7bn. The new development will be called Nairobi Gate.

Nairobi Gate, which is expected to open at the end of March next year, will be located about 15 kilometres from the Nairobi CBD. It will be on land acquired by affect, in the Northlands City precinct, a mixed-use project being developed in Ruiru, a town within 3 kilometres of Nairobi's border. Nairobi Gate is split into two buildings which are each 5,000 square metre in size. ImpAct is providing the entire infrastructure around Nairobi Gate.

The east African country is starved of modern logistics properties. Its facilities tend to be small-scale warehouses of poor building quality that do not meet standards demanded by manufacturers, e-commerce companies and pharmaceutical suppliers.

Improvon CEO Stefano Contardo said Kenya stood out as an African country to invest in while SA struggled with economic weakness and political squabbles. Kenya is forecast to grow at nearly 6 percent in 2019.

The development is Improvon's first in Kenya. The company already operates a business park in Zambia.

"Africa carries risks everywhere but conditions are improving. We have found that while SA struggles and looks slightly sketchy, other parts of the continent are looking more attractive. Kenya stands out for many reasons," Contardo said.

"Some SA companies have established themselves there already and can be tenants for our development, Kenyan businesses understand English, they are dollar based and the market is not too competitive so we can do good work there," he said.

Improvon has for 25 years built capacity to develop and let logistics and warehouse space in large industrial nodes in South Africa. Contardo said the company had considered listing a few years ago to raise capital to expand. The listing did not go ahead but the company found a strong partner in Actis which had decades of experience in investing in Africa, he said.

Louis Deppe, partner for real estate at Actis, said he was confident that Nairobi Gate would be a success and that a similar design could be replicated in other African countries.